property tax bill las vegas nevada

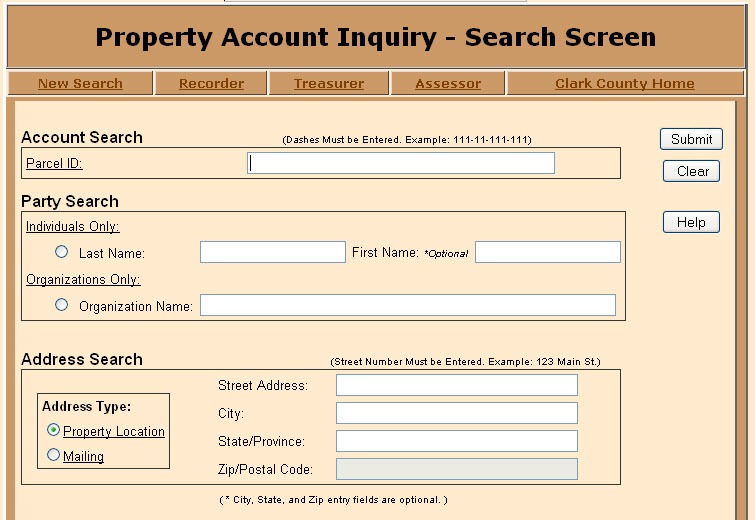

Account Search Dashes Must be Entered. 44th Street Suite 512 Phoenix.

Nevada Trust Law Companies Benefits Costs Pros Cons Taxes

500 S Grand Central Pkwy 1st Floor.

. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. In 2020 the homes assessed value was 478821 7 higher than the previous year but the homeowners annual property tax bill only increased by 3from 8932 to. Sign up to receive home sales alerts in Clark County School District in Clark County NV.

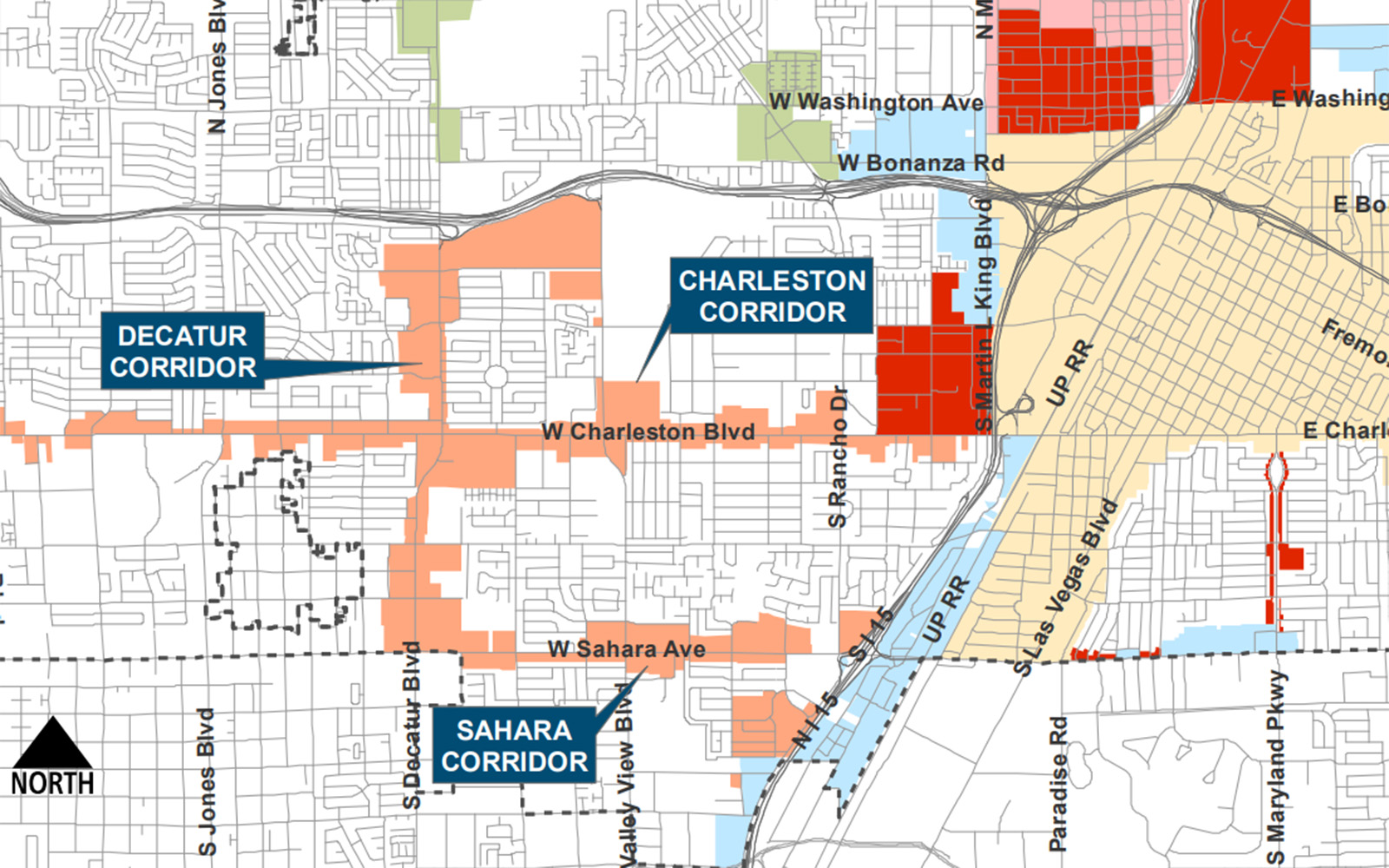

702-229-6011 TTY 7-1-1 An All-America City. If a property owner does not receive an initial property tax bill or statement by August 1 contact the Clark County Treasurer at 702 455-4323 or. With market values established Las Vegas along with other in-county public districts will calculate tax levies alone.

702-869-0955 Phoenix AZ 2999 N. CALCULATING LAS VEGAS PROPERTY TAXES. General Median Sale Price Median Property Tax.

Nevada is ranked 28th of the 50. Las Vegas NV currently has 3973 tax liens available as. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

500 S Grand Central Pkwy. Las Vegas NV 89106. In Nevada the market value of your property determines property tax amounts.

123 Main St. Las Vegas NV 89155-1220. Office of the County Treasurer.

Tax Liens List For Properties In And Near Las Vegas NV How do I check for Tax Liens and how do I buy Tax Liens in Las Vegas NV. The assessed value is equal to 35 of the taxable value. Compared to the 107 national average that rate is quite low.

Las Vegas City Hall. The states average effective property tax rate is just 053. Checks for real property tax.

801-263-9709 Las Vegas NV 8367 West Flamingo Road Suite 200 Las Vegas NV 89147 Phone. Homeowners in Nevada are protected from steep increases in. A composite rate will produce expected total tax receipts and also.

The Henderson City Council has approved a three-cent increase in property taxes from 3. Property Account Inquiry - Search Screen. Las Vegas NV 89101 Phone.

Tax bills requested through the automated system are sent to the. Craigslist pets ashtabula ohio. Nevadas median income is 66086 per year so the median yearly property tax paid by Nevada residents amounts to approximately of their yearly income.

The City of Henderson sales tax rate is 05. The Washoe County sales tax rate is 15. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be.

To calculate the tax on a new home that does not qualify for the tax abatement lets assume you have a Home in Las Vegas with a taxable value. 111-11-111-111 Address Search Street Number Must be Entered.

Mesquitegroup Com Nevada Property Tax

U S Cities With The Highest Property Taxes

Nv Energy Plan To Issue 120 Million Bill Credit Lower Rates Approved By Utility Regulators The Nevada Independent

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Clark County Assessor S Office Official Site

Property Taxes In Arizona The Basic Things You Need To Know Landmark Title Assurance Agency

The Cost Of Living In Las Vegas Upnest

Property Manager Salary In Las Vegas Nv Comparably

Clark County Homeowners Could Be Paying A Higher Property Tax Rate Klas

How Much Can Green Amenities Lower Property Tax Bills In Las Vegas Mansion Global

Taxpayer Information Henderson Nv

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Nevada Property Tax Calculator Smartasset

Irs Wage Levy Help In Las Vegas Nv Tax Crisis Institute